OPPORTUNITY ZONES 2.0

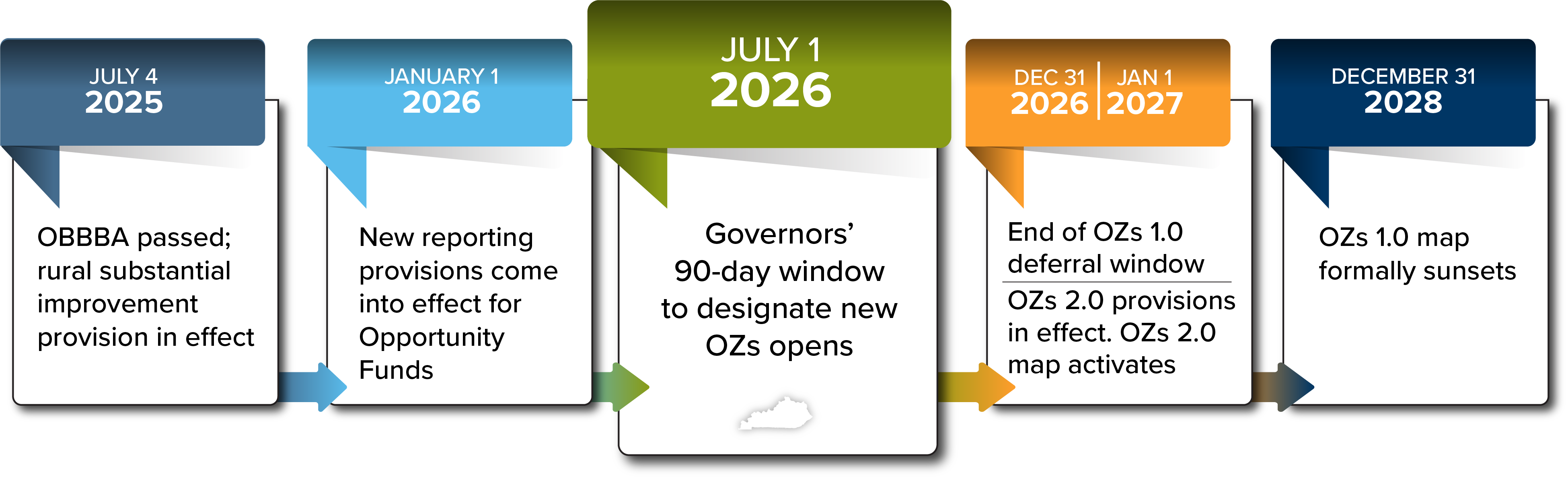

With recent federal legislation retooling the Opportunity Zone program, Kentucky has the ability to further leverage strategic investments beneficial to communities throughout our New Kentucky Home. With this opportunity, all local governments are urged to begin tailoring visions to strategic objectives supporting economic development within each community. Below is a timeline for the designation of tracts, followed by strategic thought starters to aid in each local government's planning efforts.

Timeline

Webinar

6 Key Changes in Opportunity Zones 2.0:

- Permanent Extension and New Cycle: The OZ program is now permanent, with a new, rolling designation cycle. Every 10 years, governors will propose new census tracts to be certified as OZs, starting on July 1, 2026. These new designations will be effective for a 10-year period, beginning on January 1 of the following year.

- Stricter Eligibility Criteria: The criteria for a census tract to qualify as an OZ have been tightened to target more economically distressed communities. The median family income threshold for eligibility has been lowered from 80% to 70% of the area's median. The "contiguous tract" rule has been repealed, and a new anti-gentrification measure will disqualify tracts if their median family income exceeds 125% of the applicable median.

- Rolling Gain Deferral and Simplified Basis Step-Up: For investments made after December 31, 2026, the temporary tax deferral for capital gains is now a rolling, five-year period from the date of the investment, rather than a fixed end date. The basis step-up benefit is simplified to a single 10% step-up after five years, eliminating the previous additional 5% step-up at the seven-year mark.

- Enhanced Incentives for Rural Areas: The OBBBA creates a new category of fund, the Qualified Rural Opportunity Fund (QROF), for investments in rural areas. QROFs offer significantly enhanced benefits, including a 30% basis step-up after five years (compared to 10% for non-rural OZs) and a reduced "substantial improvement" requirement for properties from 100% to 50% of the adjusted basis.

- New Reporting and Compliance Requirements: The new legislation mandates more detailed reporting from QOFs and QOZ businesses to improve transparency and program oversight. Non-compliance with these new reporting requirements will result in significant penalties.

- Gain Exclusion Cap: The permanent tax-free appreciation benefit for investments held for at least 10 years is now capped. Any gain on a QOF investment held for 30 years or more will be frozen, and any appreciation after the 30-year mark will be subject to tax.

STRATEGY FOR SUCCESS

- Set a vision for leveraging OZ investments

- Identify needs and opportunities

- Designate an OZ contact

- Source and filter governmental, investor, and stakeholder input

Threshold Questions:

Key Considerations for recommending the selection of zones- Where do priorities for revitalization exist within each community?

- Where should development be channeled to support existing economic development projects or a planned need for future growth to harmonize with identified revitalization needs?

Zoning Maps

- Consider industrial and commerical use in rural areas

- Identify census tracts with reduced barriers to development

- Consider the presence of existing structures or inventory for redevelopment

Alignment with Long-Term Development Strategy

- Identify vacant parcels within proximity to priority development areas

- Identify vacant parcels within proximity to existing industry

- Consider goals with other attraction efforts and local and state programming